Submissions to the Senate inquiry into the Bill to repeal the Australian Charities and Not-for-profits Commission (ACNC) closed Friday 2 May, 2014 – 154 were published.

There will be two Bills in the process of legislative change. The first, this one, is to repeal the ACNC Act. The second will be to establish regulatory arrangements in its place. The first bill will not come into effect until the second Bill is published.

This analysis of the submissions to the inquiry contains statistics and quotes from a review of the submissions. If you would like to print a copy, please download the PDF. It is organised under the headings:

- Who submitted

- Arguments against the Repeal Bill

- Support for the Repeal Bill

- About the ACNC.

A summary of this information was published as an article, Charities Voice Overwhelming Opposition to ACNC Repeal Bill in Pro Bono News on Monday 13 May.

The most frequently quoted and supported submissions came from the Community Council for Australia and the Queensland Law Society.

[The Creating Australia submission was published twice (numbers 16 and 146) and is thus counted as two submissions.]

Who submitted and what was their position?

Position on the ACNC (Repeal) (No.1) Bill 2014

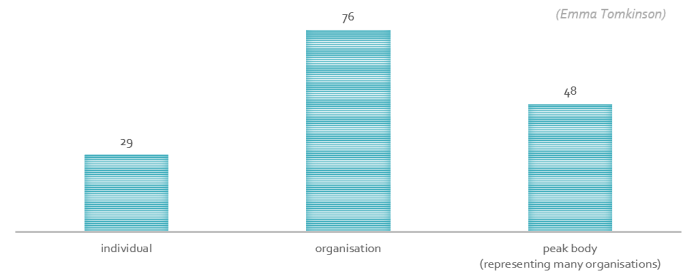

124 (81%) submissions opposed the Bill and 14 (9%) supported it. Fifteen submissions provided information or made statements to the Senate Committee, but neither stated explicit opposition nor support for the Bill. One submission was confidential.

Volunteering Australia: “The Repeal Bill and its potential consequences, if passed, is extremely disrespectful of the overwhelming support from the sector for the establishment of the ACNC, after extensive consultation, reviews, inquiries, reports etc. The Repeal Bill ignores sector feedback from several surveys which overwhelmingly supports the maintenance of the ACNC.”

The Australian Council of Social Services: “It is unusual for an industry to be championing regulation. However, as the recipient of ineffective regulation for many years, the Australian NFP sector recognises the value of an effective, sector-centred, streamlined and proportionate regulatory regime.”

Submissions came from all states

Submissions were made by peak bodies, organisations and individuals

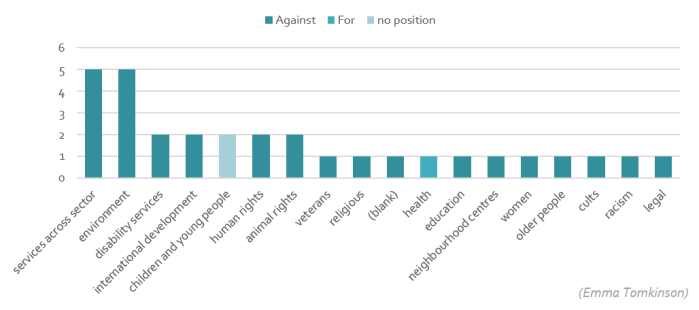

Peak bodies represented a diverse range of organisations

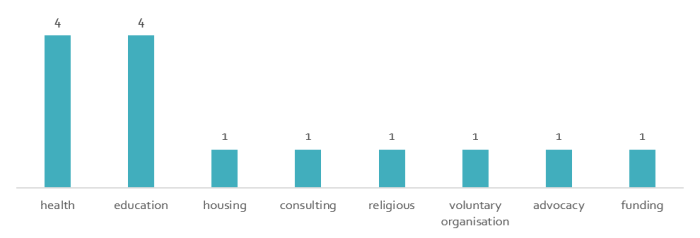

While most organisations were against the Bill, health and education showed a higher level of support than other areas.

Frontline service delivery organisations were largely against the Bill

Frontline service delivery organisations were largely against the Bill

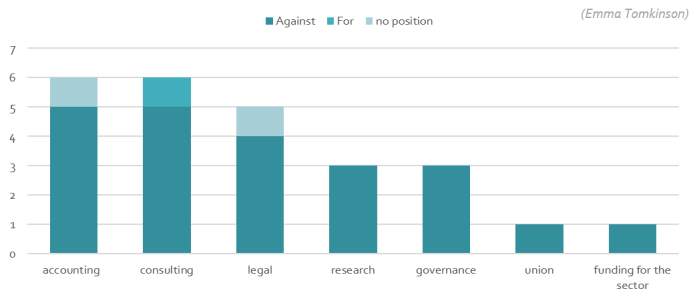

Those serving the sector were well represented

Organisations and individuals providing services to the sector were very strongly against repealing the ACNC.

Arguments against the Repeal Bill

The following sections give quotes that are representative of the arguments made. There is no intention behind the choice of whom to quote, apart from that an attempt was made to include a range of organisation.

The ACNC is the best way to reduce red tape

The St Vincent de Paul Society: “red tape will be reduced by allowing the ACNC to continue its work of reducing duplication, facilitating reporting, and promoting sector development.”

World Vision Australia: “the ACNC has also made significant progress to date in reducing unnecessary regulatory obligations.”

David Gilchrist: “The prospects for reducing red tape will be diminished greatly as the Commission is the only body within the Commonwealth machinery of government that is charged specifically with this role and which can champion red tape reduction across government.”

South Australian Council of Social Services: “The repeal of the ACNC will stop an immediate red tape reduction measure in South Australia.” They described the state-specific situation where legislation to remove state reporting requirements and abolish the burden of fundraising licences is ready to be introduced to parliament, but is on hold as it is predicated on the existence of the ACNC.

ACT Government: “uncertainty over the future of the ACNC has made it impossible for the ACT to withdraw from the regulation of the sector in the ACT, or to continue with the development of an MOU with the ACNC. The inability of the ACT to pursue its intentions in this area will result in a significant lost opportunity to reduce unnecessary administrative impact on the sector.” It estimates the cost of this opportunity at around $2m per annum.

Australian Cervical Cancer Foundation: “if the desired outcome is to reduce red tape and administrative cost and burden for Charities, then the ACNC should not be abolished, but instead should be strengthened and supported by all States and Territories (in the same way as proposed by SA and the ACT) to give it the greatest opportunity to be the national ‘one stop shop’ for charities utilising a ‘report once use often’ approach.”

All Together Now: “The formation of ACNC has crucially allowed All Together Now to have a single point of contact, avoiding time wasted in dealing with various agencies. The ACNC has also allowed us to:

- Speed up the organisation of charity tax concessions (by acting as a liaison between us and the ATO).

- Reduce the time and cost of auditing.

- Reduce the burden on our research of administrative procedures by providing various resources on day-to-day charity operations, including engaging volunteers, conflicts of interest, internal dispute resolution and financial controls.”

Don’t want to return to regulation by the ATO/ASIC

Churches of Christ Community Care: “ In its relatively short life the ACNC has proven its value to Australian Not for profit organisations in a range of ways and has demonstrated a far broader understanding of the Australian charities sector than either the ATO or ASIC.”

Wentworth Kemp Consultants: “The Tax Office is not the right regulator for the sector.”

Philanthropy Australia: “Philanthropy Australia believes that as a revenue collection agency, the ATO is best suited to administering charitable tax concessions rather than determining the charitable status of entities.”

RDL Accountants: “Most obvious has been the comparison between dealing with the Australian Taxation Office (ATO) and now the ACNC. Being able to ring the ACNC and speak (almost immediately!) to someone who understands charities is of great benefit to the sector.”

World Vision Australia: “maintains that neither of these agencies (ASIC or the ATO) is as well-positioned or well-equipped as the ACNC is in terms of their ability to focus on efficiently and effectively regulating and supporting the charitable and not-for-profit (“NFP”) sector and facilitating greater public trust in it.”

The ACNC promotes transparency and/or accountability

RSPCA Australia: “The ACNC was established after extensive consultation with the sector and is widely supported within the sector. It has already delivered a central and easily accessible place members of the community can access in order to obtain information on individual charities. The reporting and transparency is no more than what should be expected of any organisation in receipt of donor or public funds. With arrangements in place with the ACT and SA Governments, the scene is set for a realisation in a real reduction in ‘red tape’ for national charities that need to hold and maintain fundraising licenses in every jurisdiction. Currently, the reporting required in each state is different.”

Consumers Health Forum of Australia: “Consumers, who, in the health sector are contributing an increasing proportion of their own funds towards the purchase of health services, now at over 17%, deserve the best information on health services. It is essential that they have access to independent, transparent and accessible information on community and charitable health services, so that they are able to make informed health service purchasing choices. Without this level of transparency in the system, they are significantly disadvantaged in the use of the purchasing power in the health market to support well governed and robustly managed services.

“For consumers as donors or sponsors, it is also critical that transparent information is available to assist them in guiding their donation choices, so that more effective, responsible and well governed providers can leverage off that reputation.”

Wesa Chau: “Current functions of the ACNC are crucial in the process of building the NFP sector, the transparency it achieves build public confidence in giving, as well as providing data for further analysis about the NFP sector in Australia.”

The ACNC is a result of years of consultation

ACNC: “Given that the ACNC model emerged after decades of inquiries and consultation, any successor model of charity regulation needs to consider and address the regulatory deficiencies that were identified by this work and the ACNC was introduced to fix.”

UnitingCare: “The ACNC Act and associated legislation, including the Charities Act, provides a number of critical legislative protections for the sector that we regard as being absolute and non-negotiable. These include:

- the recognition of the independence of the charitable and NFP sector;

- the protection of the sector’s rights to undertake political advocacy;

- the promotion of the reduction of unnecessary regulatory obligations on the sector; and

- that regulatory oversight of the sector be undertaken under the principles of necessity, risk and proportionality.

“These protections were hard won by the sector during the development of the ACNC Act and associated legislation; and must be respected and preserved.”

The Community Council of Australia: “how disappointed we are that the extensive level of consultation and engagement with the charities sector leading up to and since the establishment of the ACNC has been dismissed by a new Government intent on pursuing its own agenda.”

Better Boards: “The ACNC was established in conjunction with significant consultation with the non-profit sector. Consultations were conducted at multiple stages of the establishment of the ACNC as well as in connection with the numerous government inquiries that preceded the ACNC’s creation and informed its parameters, objects and role in the sector. The majority of submissions publicly available supported the establishment of a body like the ACNC and feedback since its establishment has become increasingly positive. The ACNC itself has been highly consultative and responsive to the sector both during its taskforce stage and since its establishment.”

Our Community has a history of consultations and the number of submissions made to each at the end of its submission.

The ACNC public register of charities is valuable

ACNC: “While the ATO previously ‘endorsed’ charities to be tax exempt, these charities were not required to provide regular returns to the ATO. Australian governments and the public did not have basic, up-to-date, information about charities. Charities had to provide the same information to different government agencies as there was no single repository of core information. In July 2013, the enhanced ACNC Register (including a version for mobile devices) was launched as Australia’s first national online database of registered charities. The Register has increased transparency and accountability, while still preserving privacy where sufficient public interest warrants particular information be withheld from public view. Since the initial transfer of data from the ATO, the Register has grown to 60 352 charities and has had more than 335 000 views.”

Philanthropy Australia: “There were 407,359 visits to the ACNC Register between the ACNC’s establishment and April 20148, demonstrating that there is strong demand from the public for such a resource and the information it provides.”

Reach Foundation: “The introduction of the ACNC and the AIS has significantly added value for donors and funders, making it easier to identify and donate to well performing and transparent charities. The loss of a central register and the AIS system would be a major retrograde step. With the well-foreshadowed reduction in government spending in the community sector, it is even more important to have a single, accessible and trusted source for the private sector and individual donors to encourage and grow social investment and charitable giving.”

The Conservation Council South Australia: “As envisaged in the Commonwealth Grant Guidelines, for groups seeking grants or contracts, the ability to have their bona fides quickly verified by virtue of being on the register rather than having to provide evidence in every process would be a significant relief.”

The ACNC has made an impressive start

Aged and Community Services NSW and ACT: “If the Government decides to proceed to repeal it, we strongly urge that the good works that have been done and the progress made in reducing reports be retained by any subsequent body.”

Australian Women’s Health Network: an “excellent ‘one-stop’ website that is ‘user friendly’ for organisations and members of the public…For the first time, people can view on a single website platform information and data on all registered charities in Australia. This is a very important component in building the Australian community’s trust in the work and use of funds in the charities and not-for-profits sector.”

Churches of Christ Community Care: “The ACNC has shown its value by:

A. Establishing a public register of Australian charities.

B. Producing a raft of valuable resources, including fact sheets, interpretation statements, guides and reports to equip charities.

C. Providing a framework to hold our nation’s charities accountable and ensure appropriate compliance.

D. Increasing efficiency by enabling charities to deal with a one stop shop rather than a number of government departments.

E. Growing the level of trust and confidence in the Australian NFP sector.”

Rowena Skinner: “More than 83 per cent of registered charities have complied with financial reporting requirements due last month – a higher compliance rate than that achieved by any other comparable charity regulator around the world.”

John Butcher: “The ACNC has now been in operation for 16 months and has made impressive progress towards fulfilling its mission. It would represent an enormous waste of effort and loss of faith with Australia’s not-for-profit sector to abolish the ACNC for the sake of honouring an election promise that was, at best, misguided and unsupported by credible evidence.”

The ACNC grows public trust and confidence in charities

ACNC: Research commissioned by the ACNC found that trust and confidence in Australian charities increased significantly, when they understood the role of the ACNC. The research also found 77% of participants believed a public register of charities to be ‘very important’. These findings are consistent with similar surveys conducted over many years by the Charity Commission of England and Wales.

Breast Cancer Network Australia: “Australians wishing to donate should have the ability to access and research information about any charity, so they can be confident the funds they are donating are being used for the stated purpose. There have been numerous reports and instances where the public have been donating to so-called charities which are not using the funds for the purpose which was claimed.

“As an example, BCNA has over the years received a number of complaint phone calls from distressed members of the public regarding a similarly named charity which was aggressively fundraising, thinking the approach was from our organisation. On further investigation, it was discovered that the charity was not registered with the ACNC and more alarmingly had been deregistered in South Australia. However this organisation was able to continue to operate their fundraising activity in other states.

“It is not in the best interests of the sector for public confidence to be eroded as a result of organisations that do not act with integrity. A national regulator that maintains standards and has the ability to deter and even prosecute unethical and illegal behaviour can only increase confidence in the sector.”

Paxton-Hall Lawyers: “The charity sector recognises the need for accountability and that it is only through accountability that there will be confidence in the sector. Of course accountability inevitably involves a degree of reporting and therefore bureaucracy, but we think that the ACNC Act has been pitched at pretty much the right level in terms of reporting requirements. Necessarily that involves some notion of “red tape” but it is our view that not all red tape is bad. If we are to have a strong charity sector then those who give and those who receive need to be confident that moneys gifted are being appropriately used or tax concessions given appropriately used and that the best service is given for the money effectively invested.”

We have had good experiences with the ACNC

ACNC:

• The ACNC has received “45 572 telephone calls, with an average wait time of 33 seconds

• 28 231 correspondence 98% resolved within 2 days

• 55,921 pieces of written correspondence received (email, fax, paper)

• 59% of complex enquiries resolved within 5 days

• 79% of general enquiries resolved within 2 days”

John Church: “The ACNC has provided advice within 5 working days the ATO takes some 12 weeks and several phone calls.”

“Jesuit Social Services experience working with the Australian Charities and Not-for-Profits Commission over the past 18 months has, if anything, further strengthened our support for a national regulatory framework. Our interactions have been positive and we commend the Commission and its staff for the useful information they have provided; for excellent online systems; and for a willingness to engage with, and listen to, the concerns of the sector.”

Synergy XChange: “Our registration as a charity by the ACNC along with taxation charity endorsement occurred within one month of our registration submission.”

The independence of the regulator is vital

Philanthropy Australia: “In 2001, the Inquiry into the Definition of Charities and Related Organisations, commissioned by the then Howard Government, recognised the differences between these two functions and advised that they be separated. In its final report it stated that:

As a matter of principle, the Committee believes that the charitable status of an entity should stand independently of the taxation concessions that may attach to that status. We therefore favour the establishment of an independent body to be responsible for determining the charitable status of entities.”

National Disability Services: “It is telling that the ATO’s own submission to the 2001 inquiry into the Definition of Charities and Related Organisations also argued for an independent entity”

The abolition of the ACNC would be a step backwards

Life Activities Clubs Victoria Inc.: “In essence, we consider the ACNC the most advantageous innovation for the Sector (and the entire Australian community) for many years and abolition of the body would be a seriously retrograde step. The ACNC’s focus on accountability and transparency improves public confidence in the Not-For-Profit Sector and is in the interests of every Australian, whether as a recipient of the services provided or as a contributor to the cost of those services.”

War Widows’ Guild of Australia NSW Ltd: “The repeal of the ACNC legislation is a backward step and would be very disappointing for the majority of charities. For many years the growing charitable and not for profit sector has sought a more appropriate method of regulation which is more aligned to the values and concerns of charitable and not-for profit organisations.”

Conservation Council of South Australia: “If this current Bill is passed and the ACNC is repealed, the environment movement and other community organisations would lose the legislative support and protections incorporated into the ACNC Act. The ATO has no legislative guidelines or requirements to support charities or to respect their independence, so the abolition of the ACNC would be a seriously retrograde step for a vibrant civil society.”

Flawed two-stage legislative process

Philanthropy Australia: “The Australian Charities and Not-for-profits Commission (Repeal) (No. 1) Bill 2014 (‘ACNC Repeal Bill) does not specify the arrangements for replacing the ACNC as these will be set out in a subsequent Bill, and therefore Philanthropy Australia is not in a position to adequately assess the ACNC Repeal Bill and any policy alternatives to the ACNC.”

Australian Catholic Religious Against Trafficking in Humans: “It is also most unsatisfactory that people are being asked to vote on this Bill, let alone comment upon it, without first having any information provided about what the transitional arrangements are to be, or indeed what is being proposed to take the place of the ACNC.”

Institute of chartered accountants: “the two step legislative process of which the disestablishment of the ACNC is a part is problematic in itself. We consider that a constructive and useful debate cannot be undertaken with respect to the first Bill, without adequate knowledge of what is proposed in the second Bill.”

The Uniting Church in Australia National Assembly: “The Church has yet to see a well-researched justification for abolition of the ACNC and its replacement by a successor body or arrangement…We are concerned at piecemeal legislation and regulation which would keep causing compliance fatigue, overload and cost. It would be far better to have the ACNC approach as it now than a regulated body or bodies as seems to be the current Government’s intention.”

The Queensland Law Society: “The RIS states the objectives of the repeal provision (at p. 3) as being to give effect to a government election promise. We can find no direct reference to such a promise in the Coalition’s formal election platform and it was not included as a policy commitment in the Coalition’s election costings. Further, the RIS asserts that there is no need to consider alternative options ‘as this proposal is implementing an election commitment’.”

State and territory governments must work with the ACNC to reduce red tape

Price Waterhouse Coopers: “The ACNC has embarked on important work to standardise legislation and reporting requirements for NFP entities regardless of the state they operate in. The current reporting system for NFPs is onerous, cumbersome and inconsistent across states. If the ACNC is repealed, efforts to align legislation and reporting requirements will cease.”

The Governance Institute of Australia: “It would be a credit to the Australian Government if it provided the charities sector with the degree of consistency and support offered to the ‘for-profit’ sector more than a decade ago when the states referred corporations power to the Commonwealth and the Corporations Act came into being.”

National Disability Services: “If states and territories agreed to enact measures to eliminate or minimise duplication of reporting requirements, the ACNC has the potential to reduce the regulatory burden on charities, improve their accountability and transparency, and function as a central source of information and advice.”

MGI Australasia: “We recommend that the ACNC continues to remain as the national regulator for the NFP sector. However, we would welcome a greater involvement by state and territory governments to eliminate the need for multiple layers of government regulation.”

Our Community: “If the government really wants to reduce red tape, it should back the notion of state governments surrendering their not-for-profit fundraising and incorporation powers to the ACNC.”

ACNC reporting/registration process is more efficient

ACNC: “This growth [in number of charities registered] has been facilitated by the adoption of a real-time online system for charities to submit their information – through the ACNC Charity Portal. The portal was launched online in November 2013. The ACNC and the ATO have worked together to provide a single, online form for registering for charitable status and Commonwealth tax and other benefits. Previously the ATO process was paper-based, but 98.5% of applications are now made online. The separation of decision-making about charitable status has not increased the application period.”

“Amnesty International believes that the ACNC’s approach to compliance is one that is reasonable and efficient. It is less time consuming and requires fewer resources.”

The National Native Title Council: “The information to be collected by the ACNC via the Annual Information Statement reporting process is not an onerous task and is fairly minimal for native title organisations in terms of ‘red tape’.”

Western Australian Council of State School Organisations Inc. (WACSSO): “As a matter of interest we asked the treasurer of one of our affiliates how much work was involved in completing the annual information statement for the ACNC. His reply was that it was less than 15 minutes work. It involved ticking boxes, selecting items from drop down lists, including a few personal details and attaching a copy of the annual financial statement. By no stretch of the imagination can this be regarded as onerous. Fifteen minutes work a year?”

The provision of education and resources is valuable

ACNC: There have been “825 000 visits to acnc.gov.au

- Average visit is 6 minutes, people visit approximately 5 pages per visit.

- 216 000 reviews of ACNC factsheets, guides or FAQs

Riverview Church: “The ACNC has proven to be a government agency that actively promotes education to the charity sector. … The ACNC’s public website provides us with various useful and in-depth publications, including factsheets, quick tips, FAQs, guides and reports, with the aim of educating charities in areas such as governance, financial reporting, tax concessions, ongoing obligations, registration details, state regulations and other general issues impacting the charity sector.”

Save the Children Australia (SCA): “If the government proceeds with the Repeal Bill, SCA recommends that the ACNC’s key functions should be maintained. The core elements of the ACNC that should be continued because they are focused on reducing red tape, duplication and promoting transparency, include –

- The central register for NFPs and charities, which should be maintained as a free and searchable public register so that anyone can look up information about registered charities.

- The provision of advice to charities and NFPs so that information, guidance and other support regarding regulatory obligations and compliance is easily accessible and available.

- The work being undertaken with state and territory governments (as well as government agencies) to develop a ‘report-once, use-often’ reporting framework for charities.”

Lack of consultation in the development of this Bill

John Butcher: “The establishment of a national registrar for charities and not-for-profits enjoyed – and continues to enjoy – strong sector support. By contrast, there has until now been no formal, transparent, accountable, evidence-based process to support the government’s decision to abolish the ACNC.”

Our Community: “There have been at least 16 national inquiries and consultations into the Australian not-for-profit sector in the present millennium1 (roughly 1500 pages of discussion) and as many at state level. There have been a minimum of 1600 submissions to these inquiries (at a rough estimate, 12,500 pages). We are not aware of any statement in those 14,000 pages expressing satisfaction with the previous Australian system of fractured and contradictory state-based not-for-profit legislation. The proposal by the present government to return us to the previous system should not require any further investigation…All the bodies that have deliberated on this issue without being constrained by the dictates of party orthodoxy or political affiliations have found that a national body with real powers is an essential element in any rational system of Australian not-for-profit regulation. That we are going over this ground again is an insult to the Australian not-for-profit sector. The repeal of the ACNC legislation would add injury to insult.”

This Bill has created uncertainty

Uniting Care: “The ACNC Repeal Bill seeks to annul the ACNC Act in its entirety. The introduction of the Bill has created significant uncertainty for our sector and it is difficult to assess how it will impact on the sector in the absence of a clear position about whether the Commonwealth intends to have any role in the national (non-taxation) regulation of the sector.”

ADD Ministry: “The proposal not only introduces significant uncertainty and insecurity to the Charities Sector, it is also not in the best interests of the Australian community as a whole.”

The ACNC supports good governance

Governance Institute of Australia: “Our support of the ACNC is based on its light-touch presence as a regulator, its effectiveness in lifting the accountability and governance standards of charities, and its success in providing significant education to the sector and providing the sector with visibility.”

Legacy Australia Council: “we now write, as a major Australian Ex-service Organisation directly impacted by the introduction of the ACNC, to strongly support the retention, in the ACNC or any revised version of the ACNC, of its fundamental principles as a single reporting point for charities that would improve community access to NFP data, educate the sector and raise standards of governance. The set-up process is still in its early stages and has not yet had sufficient time to be fully implemented or even properly evaluated.”

Access to charity data is valuable

Australian and New Zealand Third Sector Research Inc.: “The ACNC plays a critical role in this endeavour by promoting research into the Australian not for profit sector and civil society more generally.”..” In sum, without data we are not in a position to enhance the sector’s capacity to serve the Australian community.”

ACNC: From June 2013, the ACNC took carriage of the ongoing maintenance and updating of the National Standard Chart of Accounts (NSCOA), an initiative of the Queensland University of Technology. NSCOA provides a common approach to capturing accounting information for use by not-for-profits and government. The Commonwealth, state, territory and local governments agreed through Council of Australian Governments to accept NSCOA for all reporting purposes. NSCOA, and the ACNC’s stewardship of it, has made a significant contribution to red tape reduction. One state alone has estimated savings of $3.1 million a year over ten years. In the event of the abolition of ACNC, a home needs to be found for the NSCOA initiative so its potential is not lost.

ACNC: has

- published information it has collected back to the sector and public (e.g. sector snapshots on first 250 and 1000 ACNC registered charities)

- Published data sets to data.gov.au

- Research to obtain baseline evidence of public trust and confidence in Australian charities

- Extensive report giving overview of NFP Sector Reform

- Research network established (80+ researchers)

- Research awards

A repeal will be expensive

Shepherd Centre: “Repealing the ACNC would increase the current workload on charities and forego the opportunity for future savings in workload”

Creating Australia: “Isn’t it going to be expensive to develop yet another ‘agency which succeeds the Australian Charities and Not-for-profits Commission’? Why wouldn’t you then retain the ACNC?”

ASIC: “For data collected by the ACNC, a data migration between the ACNC and ASIC may be necessary. An example of such data is financial reports of charities. ASIC may need to expend significant resources to rebuild our corporate registers. ASIC is not currently funded for this or other transition activities.” [Emma: This submission was, on the whole, neither for nor against the Bill.]

Humane Society International: “NFPs’ compliance costs are minimised when they have to face a single clear set of requirements — whether in regard to registration, tax endorsement or fundraising with common reporting standards and requirements, and where one report satisfies most, if not all, obligations. The ACNC has the ability to achieve even more in this space and it should be given the opportunity to fulfill its potential… The lack of simple, consistent and equitable regulation has a direct, negative impact on the sector, resulting in higher compliance costs for no greater protection for stakeholders. As a consequence, resources that would have been best used to serve the community, are drawn into unnecessary administration and compliance costs. The vital work of the ACNC must be maintained, for the benefit of charities, not-for-profits and the many communities they serve.”

The sector is growing

Community Council for Australia: “The not-for-profit (NFP) sector contributes over $43 billion or around 5% of GDP per annum, encompasses over 600,000 organisations ranging in size from large to very small, and is estimated to employ over one million staff (or eight per cent of all employees in Australia). Current turnover is estimated to be approximately $100 billion annually…Over the last decade, the growth in the NFP sector is second only to the mining industry and employment growth has exceeded any other industry.”

Institute of Public Accountants: “To date, it is unclear how the proposed new arrangements of transferring responsibility back to the ATO and ASIC will enhance and improve the quality of NFP regulation. Returning responsibility of determining tax concession status for NFP’s to the ATO raises a number of concerns. Conflict of interest will resurface as the ATO is solely focused on for-profit entities; lack of consistency in endorsement processes for tax concessions across jurisdictions; and whether the ATO is equipped to deal with the continued growth in the NFP sector.”

Other points

It’s too soon

The Australian Conservation Foundation: “The long-term benefits of the Australian Charities and Not-for-profit Commission (ACNC) as a central reporting body for the charitable sector are clear. Unfortunately, being in operation for such a short period of time, many of these benefits have not yet been fully realised. The ACNC has not been a ‘quick fix’ and it was never designed to be.”

We already have centres of excellence

Suggestions included:

- Australian Centre for Philanthropy and Nonprofit Studies, Queensland University of Technology

- Our Community

- The ACNC

The regulator of the sector needs to have power and willingness to pursue complaints with deregulation

Community Council for Australia: “In its first 16 months of operation, the ACNC received 686 complaints which resulted in over 250 investigations. Most of these investigations have been resolved through various forms of mediation and working with the charities themselves.

‘Previously if anyone complained to the Australian Taxation Office (ATO) about the operations of a charity, no-one knew what happened.

‘As mentioned above, once organisations are approved by either ASIC or the ATO their conduct is largely unmonitored This is in contrast to the ACNC’s approach which seems to support people in gaining registration, but more actively engage with and monitor behaviour once they are registered. Compliance activity is critical, not just because a very small minority of charities are deliberately misleading and behaving badly, but primarily to offer support that will help struggling charities become more viable.”

Support for the Repeal Bill

The organisations that made submissions in support of the Bill were:

- Anglican Church Diocese of Sydney

- Association Executive Services

- Association of Australian Medical Research Institutes

- Cancer Council Queensland

- Catholic Education Offices of Melbourne, Ballarat, Sale and Sandhurst

- Catholic Health Australia

- Centre for Civil Society

- Financial Services Council

- Housing Industry Association Ltd

- Independent Schools Council of Australia

- Mr Colin Brennan

- National Catholic Education Commission

- Neuroscience Research Australia

- Universities Australia

Points made were:

- The ACNC regime imposes reporting obligations on the trustees of charitable will trusts that did not exist formerly.

- The ACNC regime imposes specific governance standards on the trustees of charitable will trusts that are similar, though not the same, as the governance standards imposed by the Corporations Act

- The suspension, removal and replacement provisions in the ACNC Act grant powers to the Commissioner that go well beyond the powers of any other Federal regulator.”

- ACNC not beneficial for Medical Research Institutes, many of which are companies limited by guarantee

- As a company limited by guarantee we are adequately regulated by ASIC

- Existing regulation is sufficient – ACNC powers not fit for purpose for Catholic schools

- Hospital and aged care services are already highly regulated

- Regulation not beneficial or necessary for over-regulated independent schools

- We are a voluntary organisation funded by one state and feel over-regulated

Suggestions for the future

The Australian Catholic Bishops Conference: “respectfully proposes to the Committee that this Inquiry should focus more on the nature of regulation and less on the identity of the agency.”

About the ACNC

[taken from the ACNC submission (no. 95)]

The ACNC’s objects under the Australian Charities and Not-for-Profits Commission Act 2012 (Cth) (ACNC Act) are to:

- maintain, protect and enhance public trust and confidence in the Australian not-for-profit sector through increased accountability and transparency

- support and sustain a robust, vibrant, independent and innovative Australian not-for-profit sector

- promote the reduction of unnecessary regulatory obligations on the Australian not-for-profit sector.

The ACNC administers the ACNC Act, Australian Charities and Not-for-profits Commission (Consequential and Transitional) Act 2012 (Cth), and the Australian Charities and Not-for-profits Commission Regulation 2013 (No. 3) (Cth). There are 39 other pieces of legislation relevant to the ACNC’s operations which would need to be reviewed if the ACNC is abolished.

To achieve its objects, the ACNC’s functions include:

- maintaining a public register of Australian charities, currently numbering more than 60,000

- registering new charities and deregistering those which are no longer eligible

- collecting information on charities, primarily through an Annual Information Statement

- receiving and acting on complaints about registered charities

- monitoring charities for compliance with legal requirements and, if necessary, issuing charities with directions to comply

- driving the reduction of unnecessary or duplicative regulation and reporting (red tape) in the sector, in cooperation with other agencies

- providing advice and guidance to the sector and the public, to enhance the transparency and good governance of the sector.

*Declaration of interest: Emma Tomkinson is a sector researcher and analyst. She is the author of one submission opposing the ACNC Repeal Bill and has very much enjoyed engaging with the ACNC over the last six months as an external stakeholder. She is not, nor has ever been, employed by the ACNC.

Interesting. Some of the early coverage of support to ditch ACNC stressed that it was mostly Catholic groups who wanted it gone. Not sure this supports that assertion (but still can’t believe anyone wants it gone).

This was mentioned in a few submissions – it may be that the powerful Catholic education and health peak bodies have pushed hard for this, but they’re not the only organisations for the Bill. Organisations against the Bill (that want to keep the ACNC) also include Catholics and those that run schools and hospitals, so the group supporting the Bill isn’t clearly defined by a set of similarities.

That reality hasn’t come through in what I’d seen prior. Still, the bigger picture is the overwhelming support for the ACNC

Well done on this analysis, it largely reflects my own analysis, after reading all the submissions. I also agree with your commentary in the comments above.

Thanks, Kerry!

Part of the opposition to the abolition of the ACNC comes from the Universities and the enormous medical research centres, which points to one of the problems that we have and which neither retention not abolition is going to fix, which is that in Australia very different kinds of not-for-profit organisations tend to end up in the same legal form (universities and soup kitchens are both charities) and the same kind of organisations can end up in very different legal forms (it’s basically a lottery whether most NFPs become incorporated associations or companies limited by guarantee). Ideally, we’d go back to first principles (and wipe out trusts altogether).