This is an updated version of the article first published in the 2014 Charity Finance Yearbook. Download the PDF here.

Introduction

The first Social Impact Bond was developed by Social Finance, agreed with the Ministry of Justice and Big Lottery Fund and began to offer services in 2010. Since then, much interest has been generated from public bodies, investors and social sector delivery organisations at all levels in the UK and overseas.

A Social Impact Bond is an innovative way of financing welfare and other social services. It is a collaboration of government, service providers and external investors for the improvement of social outcomes. A Social Impact Bond involves a set of contracts, the basis of which is an agreement by government to pay investors for an improvement in a specific social outcome once it has been achieved. Service providers achieve improved social outcomes by delivering an intervention to a group within a target community. Investors provide working capital for service providers to deliver the intervention, thus assuming the financial risk. Intermediaries have also been involved to develop agreements between parties, design effective programmes, raise finance and manage service performance.

The Centre for Social Impact Bonds (UK Cabinet Office) defines a Social Impact Bond as an arrangement with four necessary features:

- a contract between a commissioner and a legally separate entity ‘the delivery agency’

- a particular social outcome or outcomes which, if achieved by the delivery agency, will activate a payment or payments from the commissioner

- at least one investor that is a legally separate entity from the delivery agency and the commissioner

- some or all of the financial risk of non-delivery of outcomes sits with the investor.[1]

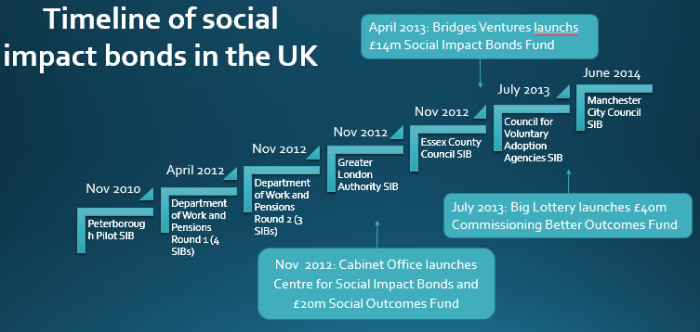

The timeline of UK Social Impact Bond milestones below shows the significant responses by the Government and investors to a nascent market.

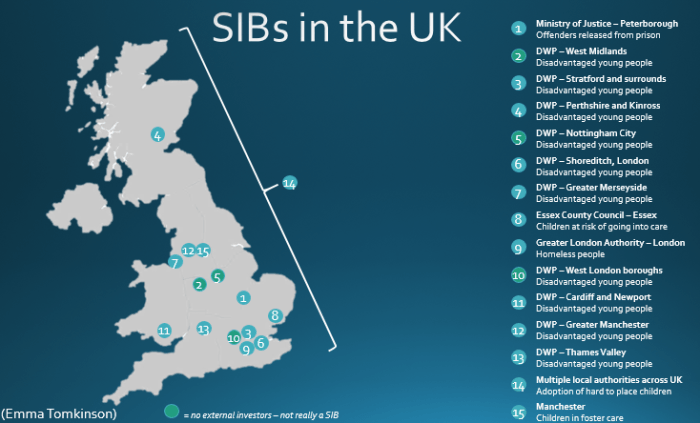

Social Impact Bonds in the UK

Peterborough pilot – reducing reoffending

Aims

The Peterborough Social Impact Bond aims to reduce the reoffending of approximately 3000 male prisoners who are or will be discharged from HMP Peterborough after serving a sentence of less than 12 months. Services began in September 2010 and were expected to take about six years for the 3000 prisoners to be discharged. Due to the Transforming Rehabilitation programme, where mandatory services will be delivered to all short-sentenced prisoners, the SIB will conclude early, in June 2015. Preliminary figures released by the Ministry of Justice are promising, however the measurement that will determine whether the first payments are made has not been published.

Organisations involved

Social Finance developed the model, raised the finance and is performance managing this Social Impact Bond. The Ministry of Justice commissioned the service, with part of the outcome payments contributed by the Big Lottery Fund. St Giles Trust; Ormiston Children and Families Trust (Ormiston); SOVA; YMCA; Peterborough and Fenland Mind (Mind) are each delivering different facets of the holistic service, called the One Service.

Investors

The investment pool totalled £5 million from 17 social investors including: the Barrow Cadbury Charitable Trust; the Esmée Fairbairn Foundation; the Friends Provident Foundation; the Henry Smith Charity; the Johansson Family Foundation; the Lankelly Chase Foundation; the Monument Trust; the Panahpur Charitable Trust; the Paul Hamlyn Foundation; and the Tudor Trust.

Terms

If re-offending is reduced overall by at least 7.5%, investors receive a minimum repayment of 2.5%. The greater the drop in re-offending beyond this threshold, the more the investors will receive. The total payments by Government are capped at £8m (or £7m in real terms) and return to investors is capped at 13% annual IRR.

Essex – supporting children on the edge of care

Aims

The Essex Social Impact Bond aims to reduce care days for children on the edge of care or custody, focussing on those aged 11-16 years. The programme uses the evidence-based Multi-Systemic Therapy to deliver services over five years to 380 children and their families. Services will be delivered for five months, but outcomes will be measured over 30 months. Contracts were agreed in November 2012 and services began in the first half of 2013.

Organisations involved

Social Finance developed the model, raised the finance and is performance managing this Social Impact Bond. Essex County Council commissioned the service with the support of the Department of Work and Pensions, the Department for Education and the Department of Health. The Multi-Systemic Therapy services are delivered by Action for Children.

Investors

Social investors contributed £3.1m and include the King Baudouin Foundation, Esmée Fairbairn Foundation, Barrow Cadbury Trust, the Tudor Trust, David Burnett through the Charities Aid Foundation, Bridges Ventures, Big Society Capital and the Social Venture Fund.

Terms

The target is an equivalent of 110 young people diverted from care and the targeted returns are 8-12% IRR.

London – reducing rough sleeping

Aims

The London Social Impact Bond aims to improve the outcomes of 831 identified rough sleepers. This cohort is split between two roughly equal contracts and providers. There are five outcomes related to payment: reduction in numbers seen sleeping rough; sustained moves to settled accommodation; reconnection of foreign nationals to accommodation in their home country; increased employment; reduction in accident and emergency visits. Services begun in November 2012 and will continue for three years.

Organisations involved

This Social Impact Bond was commissioned by the Greater London Authority, but is funded by the Department for Communities and Local Government. Services are delivered by St Mungos and Thames Reach through two separate contracts.

Investors

A number of individuals invested alongside St Mungos, Thames Reach, CAF Venturesome, Department of Health Social Enterprise Investment Bond, Orp Foundation and Big Issue Invest. Services are funded by service providers and investors and will share both the financial risk and the potential financial reward.

Terms

Outcome payments are made quarterly with the first payments made in February 2013. Payments are capped at £5m including administration and development costs.

Department of Work and Pensions Innovation Fund

Aims

The Department of Work and Pensions have commissioned ten Payment by Results programmes in two rounds through their Innovation Fund. The programmes will support up to 17,000 disadvantaged young people over a three year period to re-engage with education in order to ultimately gain employment. Round one supported young people aged 14 to 24 years of age and round two supports disadvantaged young people aged 14 and 15 year olds only. Not all of the programmes fit the definition of a Social Impact Bond, as some do not have external investors (these are italicised in the table below).

Organisations involved

| Organiser | Service Provider(s) | Fund Raiser/Investor | Name of Service | Location |

| Indigo Project Solutions (an intermediary body) | YMCA Perth | Indigo raised funds – 12 investors – all local businesses or individuals – who were keen to be engaged directly | Living Balance | Perthshire and Kinross |

| Private Equity Foundation | Tomorrow’s People | impetus-PEF raised £1m from BSC | ThinkForward | Shoreditch, London |

| Stratford Development Partnership | Community Links | Bridges Ventures co-invested with Stratford Development Partnerships | Links4Life | Stratford, Canning Town, Royal Docks (Newham), Cathall (Waltham Forest) |

| Triodos | GMCP | Triodos Bank raised £1.5m | Triodos New Horizons | Greater Merseyside |

| Social Finance | Teens and Toddlers | Social Finance raised investment | Teens and Toddlers Innovation | Greater Manchester – Manchester, Salford, Bolton, Oldham, Tameside |

| Social Finance | Adviza | Social Finance raised investment | Energise Innovation | Thames Valley – Bracknell Forest BC, Buckinghamshire CC, Milton Keynes Council, Oxfordshire CC, Reading BC, Slough BC, West Berkshire DC, Royal Borough of Windsor and Maidenhead, Wokingham BC |

| 3SC | CfBT/Include and Dyslexia Action | 3SC co-invested with Big Society Capital | 3SC Capitalise | Cardiff and Newport |

| APM UK Ltd (Australian-owned for profit work contractor) | 11 not for profit organisations – part of Birmingham Employment, Skills and Training Network (BEST Network) | APM UK Ltd invested £3m themselves | Advance | West Midlands – every Birmingham Ward |

| Nottingham City Council | Nottingham City Council and Nottingham Futures (a wholly owned company of Nott City and County Councils) | no external funds are involved | Employer Hub and Nottingham Futures | Nottingham City |

| Prevista | Catalyst Gateway, Fit for Sport, Twist, Positive Arts, Arrival Education | Prevista invested | 5 services under ‘Innovation Fund’ | West London boroughs of Brent, Ealing, Hammersmith & Fulham, Hounslow, Westminster and Haringey |

Terms

Payments are made monthly on the basis of a range of outcomes. The total investment from external investors is around £10m and the total maximum payments for outcomes amount to £28.4m.

It’s All About Me – adoption

Aims

It’s All About Me aims to find adoptive families for children for whom it is more difficult for Local Authorities to place. It also involves support for children and families to achieve better outcomes and reduce the likelihood of breakdown.

Organisations involved

The structure of this Social Impact Bond is very different from those that preceded it, as there are multiple commissioners and service providers who refer cases and respond as needed. The model has been developed with the Council of Voluntary Adoption Agencies by Jim Clifford of Baker Tilly. The Cabinet Office’s Social Outcomes Fund will contribute to outcome payments. Placement services are provided by a network of Voluntary Adoption Agencies, initially these will be Action for Children, After Adoption, Adoption Matters Northwest, Caritas Care, PACT, TACT, Faith in Families and St Francis.

Terms

Investors will receive a four per cent per annum return, with the potential for greater returns if the adoption placements are successful. CVAA hopes to raise £5.5m from investors over the first year.

Manchester – vulnerable children

Aims

The Manchester Vulnerable Children Social Impact Bond aims to improve outcomes for adolescents in residential care to the point where they can stably live in a family environment. It delivers the well-evidenced Multi-Dimensional Treatment Foster Care (for adolescents). The programme plans to involve 95 children.

Organisations involved

The commissioner is Manchester City Council. Social Finance has advised on the development of the model and Action for Children will deliver the services.

Investors

Investment has been made through the Bridges Social Impact Bond Fund. Investors in the fund are Big Society Capital, Omidyar Network, Panaphur and Bridges Social Entrepreneurs Fund. The Cabinet Office’s Social Outcomes Fund will contribute to outcome payments. Terms are unknown.

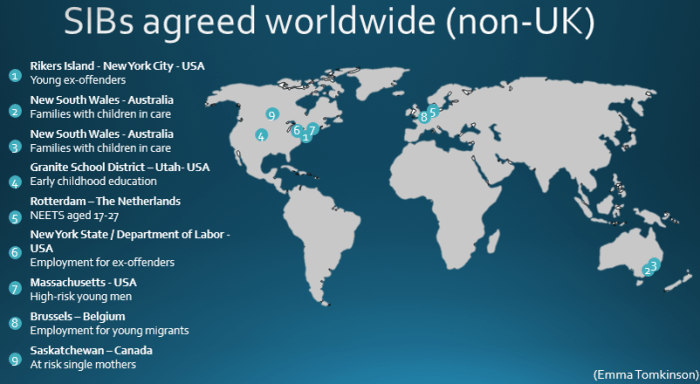

Social Impact Bonds and Development Impact Bonds outside the UK

Social Impact Bonds have attracted global interest and attention. The chart above features the US and Australia separately as they are the only jurisdictions apart from the UK that have Social Impact Bonds delivering services.

The first Social Impact Bond developed in the US in 2012 aims to reduce reoffending for juveniles released from the Rikers Island Prison. It differs from the UK examples in that Bloomberg Philanthropies has guaranteed 75% of the investment put up by a single investor, Goldman Sachs. A second Social Impact Bond was agreed in Salt Lake County, Utah in 2013 for services in early childhood education. Social Impact Bonds are also referred to as Pay for Success or Pay for Performance programmes in the US.

The state of New South Wales in Australia has used the term Social Benefit Bonds to refer to Social Impact Bonds. In 2013 they announced two that aim to strengthen families, in order to keep children with their parents or return them from care. Both involve varying degrees of government guarantee of capital. Returns differ across guarantee levels with maximum returns from 10% to 30% IRR.

2013 saw the introduction of Development Impact Bonds concept by Social Finance and the Centre for Global Development. Development Impact Bonds differ from Social Impact Bonds in that foreign donor agencies contribute all or part of the outcomes payments.

In 2014 we have seen Social Impact Bonds emerge to engage to support:

- young people not in education, employment or training in Rotterdam, the Netherlands

- ex-offenders to find employment in New York State, USA

- high risk young men in Massachusetts, USA

- young migrants seeking employment in Brussels, Belgium

- single mothers in Saskatchewan, Canada.

Criticisms and responses

Why is it complex and costly to develop a Social Impact Bond? Social Impact Bonds look at complex social issues and bring in a number of different partners to design a solution. They require a lot of change for the organisations involved which is time consuming. Outcomes-based contracts are new for many commissioners – developing measurement and valuations of outcomes involves a lot of learning and change. This change extends to accounting, legal and procurement practices. Organisations that have developed Social Impact Bonds report enormous benefit from the process and are able to apply their newfound knowledge across other service programmes.

Are Social Impact Bonds an excuse for privatisation? Social Impact Bonds have focussed on additional services in order to improve social outcomes for service users and reduce or control demand for acute or crisis care. Social Impact Bonds are not the best way to deliver every public service – careful consideration has gone into the suitability of the model each time it has been employed.

Is it wrong for investors to be making a profit from investing in services for disadvantaged people? Investors are not profiting from vulnerable people but are investing in services to help them. They risk losing their capital if services fail, but are compensated for that risk with returns, should the service succeed. Commissioners who have developed Social Impact Bonds have assessed the model to assist with improving value for money from public spending, largely because they remove the cost of programme failure and allow preventative services to be established. An additional consideration is that Social Impact Bond investors in the UK have so far been social investors, many of whom have a mandate to further invest returns in social programmes.

[1] Cabinet Office, 2013, Social Impact Bond Knowledge Box http://data.gov.uk/sib_knowledge_box/sib-definition

[…] Social Impact Bonds In The UK: An Overview Emma Tomkinson […]