Two common misconceptions about social impact bonds are:

- That the amount the commissioner (Government) will need to payout can be calculated by taking the amount initially invested and adding a return.

- That the total cost of operations (running the intervention services) is the amount required from investors

Investors pay the entire cost of operations

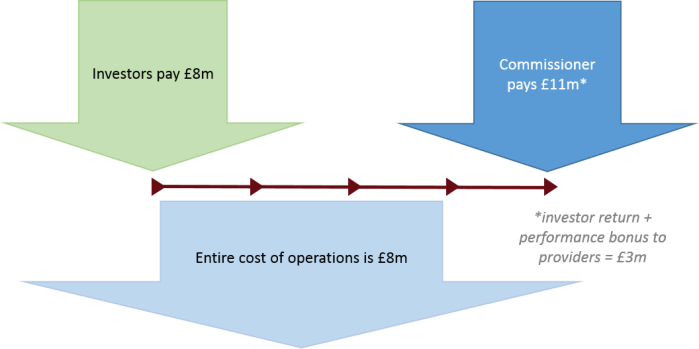

The diagram below might spring to mind when we hear the word ‘bond’ (amounts below are illustrative only):

In this diagram, the investors pay £8m before the start of £8m worth of operations. After services finish there is a short delay for measurement after which the commissioner (Government) pays back the £8m + interest for investors + performance bonuses for providers of services, so let’s say £11m.

Now this is roughly what happens and some social impact bonds might be set up exactly like this. But it’s not very efficient and that much investment isn’t always necessary.

Investors provide working capital until commissioner payments flow

We need to remember that the role of investors in social impact bonds is to cover the working capital required until payments from the commissioner kick in. Social impact bonds use outcomes based contracts, a model of payment-by-results or pay-for-success. It may be that results or success are measured, and payments are made, well before operations finish.

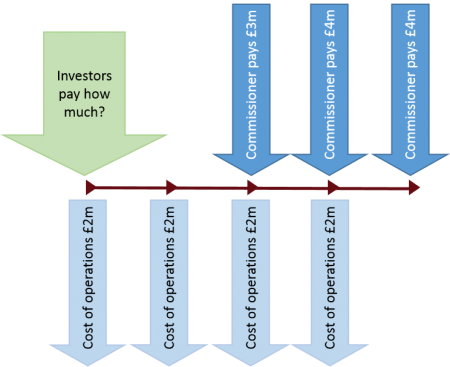

Consider the situation shown below, where payments from the commissioner begin to be made halfway through operations.

How much working capital do investors need to provide before the commissioner payments begin and are able to cover the cost of operations? Our £8m has become £4m. The shorter measurement period means earlier commissioner payments and lower investor capital requirements. It may also result in lower cost to the commissioner, although this it not portrayed in the diagram. On the other hand, it is important to note that a longer measurement period allows for a larger sample size and greater statistical confidence.

Summary

Social impact bonds can be structured in many different ways. Always assume that the timing and conditions of cash flows are deliberately constructed to balance the needs of stakeholders. Good design will simultaneously attempt to reduce investor risk and capital, reduce cost to the commissioner, minimise complexity and increase measurement confidence.

Hi Emma,

this is a great summary and really easy to understand. I’m about to run a conference on investment in youth employment pathways for disadvantaged groups and I’d love to talk to you about it, and the impact the Social Bonds scheme could have on this area.

Are you based in Sydney or the UK? If you’re interested we’d love to at least provide a link to your ideas on our blogsite, as our delegates would be really interested, I think.

cheers

Catherine